By akademiotoelektronik, 10/02/2023

Mobile payment at ING: Yes, with Apple Pay in 2020

Update December 22, 2021: ING has announced to withdraw definitively from the French market.Its offer is no longer accessible to new customers since this date.You can find the online banks comparator available here.To find out more about mobile payment, it's here.

Mobile payment is to dematerialize a bank card.To pay for your purchases in a business or on the Internet, you just have to position your mobile phone in the face of a terminal or flash a QR code.Called M-payment, this service has the advantage of removing the physical bank card but also the cash.Consequently, what does ING offer in terms of mobile payment?

The mobile payment service wins the membership of more and more French people to be equipped with a smartphone.Online banks seize this opportunity to improve their offer by making their bank cards compatible with existing mobile payment solutions on the market.But, on this subject, the online bank is late.A delay, however, about being filled with the next launch of Apple Pay at ING.

© Apple

Ing mobile payment operation

To convince, mobile payment is based on three assets: its simplicity, speed and safety.Ing mobile payment is simple because you just have to download the mobile wallet to your smartphone to link the ING bank card portfolio.Thus, the user just needs to enter their bank details only to one and only.

In supermarkets or in stores, you must put your smartphone on the area designed for this purpose of the terminal or the terminal.Their compatibility is nevertheless compulsory.The contactless payment procedure works thanks to NFC technology.The SIM card chip immediately connects to the payment terminal.Consequences: the transaction is fast and perfectly secure.

Another possibility is to opt for the QR code.The user downloads the application and associates this little black and white square with their means of payment.When paying its expenses or online purchase basket, just open the application and flash the QR code thanks to the smartphone.

Bon à savoir : le paiement mobile est plus intéressant que le paiement sans contact.For what ?Because the first only allows operations to be paid less than 30 euros, while the second ceiling is identical to that of its ING bank card.

Mobile payment figures in France

When we observe the data of this service in France, we understand better why the arrival of mobile payment ING.Indeed, according to the Baromobile 2018 study, 91% of French people aged 15 to 60 know the existence of mobile payment.40% declare themselves favorable to its use, knowing that 19% of Millennials are already using it.

A Statistica study, published in May 2019, estimated at 2.2% the penetration rate of mobile payment in France.This score is relatively low compared to other European countries such as Spain or the United Kingdom (8.8%).And even very low compared to the Asian market: the use of M-payment reaches 35.2% in China, mainly via QR code technology.

France is therefore a market for online banks in terms of mobile payment, including ING.Especially since mobile payment represents 108.8 billion transactions worldwide in 2019.However, the French remain reluctant due to a lack of confidence in the safety of transactions and a cultural predominance of the bank card and species.It is also necessary to add to this table competition of contactless payment.

These reasons do not necessarily encourage banks to offer this innovative service to their customers.Except that young people are particularly requesting.However, this is a very important audience for banking establishments.Hence the desire to offer mobile payment at ING in 2020, by establishing an agreement with the most used Wallet in the world: Apple Pay.To find out more about the range offered by the bank, here is our opinion on ING.

Solutions available on the market

If the Ing mobile payment service has delayed being offered, there are many solutions on the market.

Apple Pay ING for 2020

The arrival of Apple Pay in France dates back to 2016.However, the craze has not been expected, traditional banks favoring their home mobile payment service.But Apple Pay ended up democratizing and will cover almost all banking establishments at the end of 2020.Apple Pay ING must for example be promoted in the first half of 2020.The online bank however delayed its launch which was initially to take place in the first quarter of 2020.

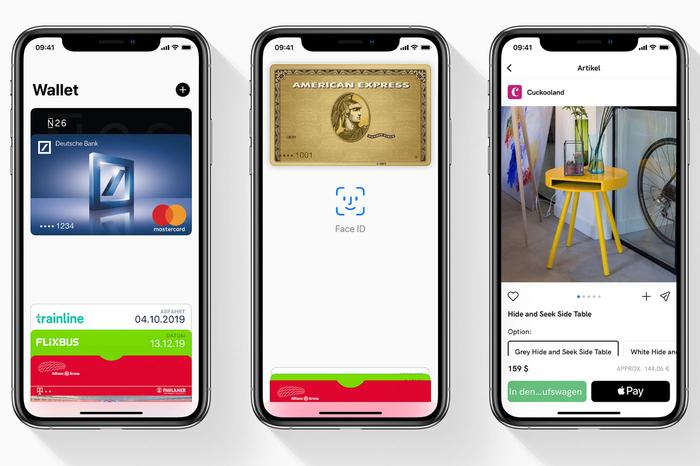

How does Apple Pay work, this Apple mobile payment solution?The ING customer will have to be equipped with an iPhone (range of iPhone 6 and subsequent).Other possible equipment: iPad (iPad mini 3 or iPad Air 2 and subsequent) or Apple Watch (connected watch).To configure the wallet, the subscriber must go to the portfolio application and click on the button (+) located in the top right.He has the possibility of dematerializing several bank cards and other loyalty cards.How ?Thanks to a simple photograph of his payment method, or simply by the manual entry of bank details.

Google Pay for Android holders

The Google Pay solution is the fruit of the merger of Google Wallet and Android Pay in January 2018.She did not land in France until a year later but is slow to seduce banks.The user must download the application from an APK portal in order to enter their Google account and add a bank card to the Wallet.The latter is compatible with Android smartphones with NFC technology.

Samsung Pay to pay with a galaxy

Access to the Samsung Pay M-payment solution has been possible in France since April 2018.On the other hand, ING does not offer this mobile payment solution.Online bank has also not communicated on a possible medium.Compatible devices are the Galaxy smartphones of the Korean brand, that is to say the Galaxy A5 and subsequent, and the whole range of Galaxy S, from the Galaxy S7.

What is the distinction between Apple Pay and Google Pay?The latter also authorizes contactless payment on a terminal which is not compatible with technology.How ?Because Samsung Pay incorporates MST (Magnetic Secure Transmission) technology).The mobile phone emits a low -range magnetic field which simulates a shift in the bank card.This CB contactless swipe to validate the transaction.

Another peculiarity: Samsung Pay offers the opportunity to dematerialize reduction cards or the Ticket Restaurant Edenred card.Authentication is done via a classic pine code or by biometric elements such as fingerprints or iris recognition.

Paylib, French payment solution accessible from his bank's app

To respond to competition from tech giants, BNP Paribas, Société Générale and Banque Postale have implemented the payment solution, Paylib.It is perceived as a banking service which nevertheless requires going through the banking mobile application of its establishment.Again, ING ignores this Paylib mobile payment.

Launched in 2013, Paylib attracted 2.3 million users (figures for the month of September 2019).The pace of monthly growth amounts to 15% (data in June 2019).This solution allows mobile payment in store and online, but also the transfer of funds between a friend via the "Paylib with friends" service.However, this service is only compatible on Android.

Lyf Pay, mobile payment integrated into the service aggregator

2.5 million times is the number of application downloads since its launch in May 2017.Thus, Lyf Pay constitutes another tricolor mobile payment solution, the fruit of the reflection of the large BNP Paribas and Crédit Mutuel banking groups.

Available on Android and iOS, Lyf Pay is part of a logic of service aggregation.Mobile payment is therefore only one service among others.With Lyf Pay, the consumer can pay for their shopping in stores, present their loyalty cards, make peer-to-peer transfers, dematerialize their cash tickets and create prints.ING customers can quite use Lyf Pay as an alternative to mobile payment.

Conclusion on mobile payment ING

Mobile payment ING must logically be set up in 2020, in particular with a woven partnership with Apple Pay.The enthusiasm of 18-35 year olds for this regulation modality and the rate of equipment in smartphones of the population encourage online banks to offer this innovative service.It remains to be seen whether ING will go in the future to other solutions to satisfy all of its customers.

Related Articles