By akademiotoelektronik, 24/09/2022

Who really benefits from mobile telematics?

0

La technologie a changé, les assurés sont moins frileux, mais au-delà d’une meilleure sélection des risques, où est le retour sur investissement ?"The insured uses mobile telematics are 15-25 % more profitable than those who do not use insurance for use".This is the conclusion of the Swiss credit report on the results of the main American insurance players in insurance.How do they do ?Can French insurers hope for an identical boost if they reject telematics?

Certain factors are clearly due to the size of the average premium and the behavior of drivers in the United States.Two examples: the average mileage is 23,000 per year (vs 13,000 in France) and in the US, more than 40 % of journeys include at least one distraction body by the phone.Why is it important ?CMT news calculated that 10 % reduction in steering wheel distraction reduces the probability of accidents by 1.33 %.However, the same Swiss credit analysis shows that a decrease of 1 % in the frequency of loss would increase insurers' income by around 9 %.

This is a start, but how to reduce the driving distraction?Well, in the past 10 years, CMT has been able to measure that 53 % of drivers participating in connected insurance programs have shown a statistically significant improvement in the first six weeks as well as beyond the use ofthe application.

For example, the Boston's most prudent driver's competition in 2019 gave rise to:

Closer to home, Huk Coburg's CEO - the first German automotive insurer - announced at the beginning of the month that between 80 and 90 % of customers in their telematics have improved their driving.

Mobile telematics detects risk behavior and has the power to change them.In Germany maybe it will be speed, in Italy, sudden braking, in France?...Who knows ?

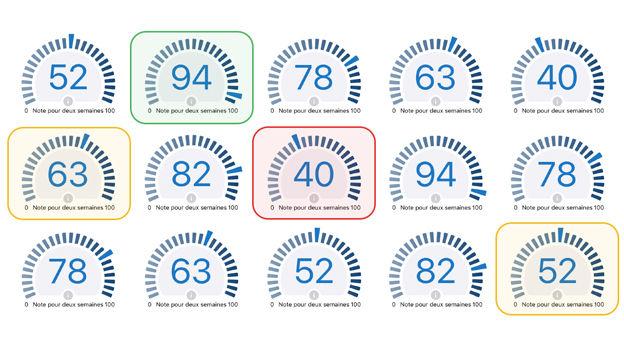

In the above illustrations, it should be noted that the participants are of all ages and any risk.So it is very clear that the benefits of telematics will be directly linked to the chosen model, so I tried to classify and illustrate the main advantages in a slightly more generic way.

Risk reduction linked to behavioral changes

Mobile telematics allows an essential continuous return of information to behavioral changes.Variations in lodification models, including types of rewards, amounts and timing, are all factors that can amplify risk reduction rates.

A British study by Lexis Nexis demonstrated that drivers who subscribe to an insurance program for use become more cautious: they reduce their fatal risk of an accident by around 50 % and decrease their daily frequency of sudden braking by 21% on average after six months.

A study by the Italian National Association of Insurance Companies (Ania) concluded that the frequency of claims of vehicle insured with a telematics police for drivers aged 18 to 25 in Naples was 26.8 % lower thanthat of the same segment without telematic insurance.

Better risk selection

Self-selection still plays a key role in the selection of risks, both in acquisition and renewal, but only on the markets where insurance for use is not limited to a niche, like C'is the case in Germany.

A veteran of connected insurance, Discovery Inure (South Africa), noted in his white paper that participants in the “Vitality Drive” program presented 24 % less accident risk than other drivers with equivalent profile.

A more precise and more neutral pricing

Telematic data also complete static variables to determine the risk with more precision and to an individual level.Individual ratings based on sensors can be integrated into an existing or used car insurance product to create new insurance products.

Today, some insurers have announced that they were only going to use telematics to switch all their customers.Their reasoning is based on their experience and that of their customers:

More efficient claims and complaints

Loss control is one of the areas where telematics improves customer experience and combined ratios.The same technology can be used for detection, assistance, sorting and estimation of repair costs.

This process also makes it possible to detect fraudulent complaints.For example, the Insurance Observatory in Italy has drawn up an international complaint programs that give the best results:

In the end, insurers using mobile telematics found their return on investment at three levels: better risk quality in the segment (and in Germany on the whole portfolio), better competitiveness on prices and quality of service and areduction of claims and costs related to claims.

You will find more details in our report on telematics values proposals in Europe downloadable for free here.Do not hesitate to contact us directly if you have any questions.

Thomas Hallauer, Director of Research and Marketing, Cambridge Mobile Telematics

I have been working in the field of telematics, connected vehicles and fleet management for over twenty years.I have seen and analyzed a large number of products and models in the connected insurance, autonomous vehicle and electronic toll sectors.Within CMT I take care of market research and communication.

If you have any questions or reactions, do not hesitate to contact me directly: Thallauer@cmtelematics.com

Contents offered by CMT

Related Articles