By akademiotoelektronik, 01/04/2022

The United States, the world's leading oil producer in 2017?

The development potential of shale oils appears uncertain.

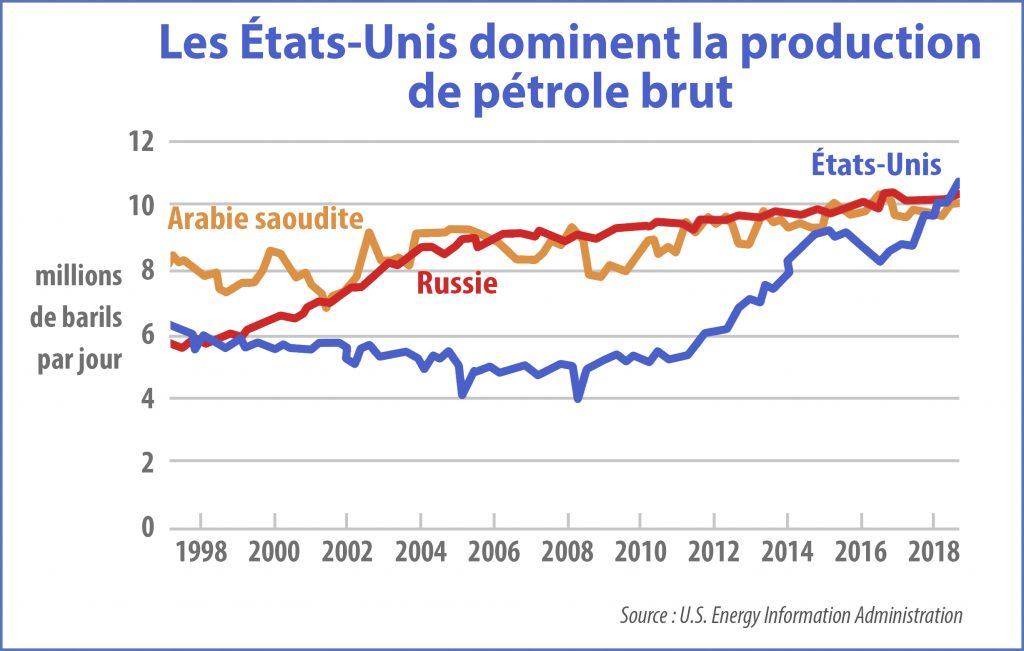

US crude oil production will surpass that of Saudi Arabia in 2017, the International Energy Agency (IEA) announced in its annual report, released on November 12.

Thanks to the shale oil boom, the American crude oil extraction industry is on the way to becoming the world's number one again.

The resurgence of production in the United States, which began in 2007, would allow Uncle Sam to reclaim his throne as oil king, lost to Saudi Arabia after the start of the decline in American production in 1971. Provided that this resurgence continues.

North America (United States & Canada) will go so far as to once again become a net exporter of crude oil by 2030, predicts the IEA. A development likely to redistribute the cards of global geopolitics as never since the fall of the Berlin Wall. According to Fatih Birol, chief economist of the IEA, “the foundations of the global energy system are shifting”.

The announcement by the International Energy Agency is of course causing a lot of noise.

In France, Dominique Seux, editorial writer for Les Echos, took the opportunity and his audience with the 1.6 million listeners of the morning segment of France Inter to ask President Hollande to "free himself from the Greens", and authorizes the exploitation of shale gas and oil in France.

Dominique Seux stresses that the United States is “getting closer to energy independence”. The world's largest economy still has a long way to go. In 2011, the United States extracted 7.8 million barrels of crude per day (Mb/d), to which are added [corr.] 1 Mb/d of biofuels. In total, American oil production (and its various substitutes and by-products) reached 10.9 Mb/d, and is therefore already almost on a par with those of Russia and Saudi Arabia. However, still in 2011, the United States consumed 18.8 million barrels every day.

The current recovery in US oil production is nonetheless “spectacular”, to use the expression used in the IEA report.

How long can the resumption of American black gold production last? Miracle or mirage?

The IEA's estimates are in line with those of the US Department of Energy, which predicts that as of next year, total US production of liquid fuels (including biofuels) will reach 11.4 Mb/d, approaching the production of crude oil from Saudi Arabia (11.6 Mb/d expected).

A first downside: the projections of the IEA, like those of the American Department of Energy, add to the production of oil that of liquid natural gas (in English NGL, for Natural Gas Liquid). NGLs, essentially propane, cannot, in most cases, replace petroleum. In particular, only a third of NGL can be used as fuel for an engine. If these NGLs are excluded, American crude oil production in the strict sense only reaches 6.2 Mb/d, while that of Saudi Arabia amounts to 9.9 Mb/d. According to Chris Nelder, an independent American oil expert, to say that American production will soon equal Saudi production “is like saying that a café-crème contains as much coffee as an espresso”.

The heart of the matter now: how long can the boom in shale oil production in the United States continue?

Shale oil production is currently developing mainly in the state of North Dakota, on the so-called Bakken geological formation.

The rush to North Dakota, a cold and isolated state on the Canadian border, has attracted many journalists. Oddly, very few colleagues have considered the case of the neighboring American state of North Dakota, over which the Bakken formation also extends, and where the exploitation of shale oil is older: Montana.

Shale oil production in the state of Montana has been declining since 2006, after peaking at just over 100,000 barrels per day.

The decline of Montana shale oils has been rapid. Yet since 2006, the number of wells has continued to grow there, says Bob Brackett, an analyst from Bernstein Research, author of a study on the development potential of the Bakken formation.

Bob Brackett provides an explanation for Montana's decline familiar to 'oil man' readers, in an interview published in July:

The typical profile of shale oil wells is characterized by an almost immediate and extremely rapid decline in extractions:

The fracturing of the rock only releases the hydrocarbons within a restricted area. Maintaining high production therefore means constantly digging new wells (as we have already explained here). The production of shale oil requires the drilling of ten to a hundred times more wells than for conventional oil, indicates the management of the French group Total.

It takes about six years, as seen in the graph above, for a well in the Bakken formation to become nearly depleted, becoming what in industry slang is called a "stripper". that is to say a very unproductive well. For now, the Bakken formation has only 200 strippers among its recent wells. In six years, according to Brackett, there should be 4,000, constituting [corr.] the majority of wells drilled since the start of the boom in 2006.

The accessible resources in North Dakota appear to be much greater than those which appear to be running out in neighboring Montana.

Bob Brackett nevertheless describes the nature of the trap that could close on the hope of the revival of American production of black gold:

Production is expected to grow further in North Dakota. But so are production costs, for necessarily increasingly mediocre results over time. The American shale oil extraction industry has set out to run ever faster on a conveyor belt that is itself ever faster, in the opposite direction. Warm ! (I'm not talking about the climate impact.)

The US Department of Energy is considering, all in all, a relatively modest increase in total production from compact reservoirs: less than 1.5 Mb/d at the peak, located before 2030, compared to around 0.6 Mb/d today. today, according to the reference scenario (pdf, 5.9 MB). Nothing that, in and of itself, can radically change anything about American energy dependence.

The experts of the International Energy Agency themselves admit that they are far from having absolute confidence in their own prognosis, which nonetheless makes headlines almost everywhere in the economic press.

Fatih Birol, the IEA's chief economist, takes the trouble to point out that the geology and performance of compact reservoirs in the United States are still "poorly known", and that it is not certain that new reserves are accessible in sufficient quantities to maintain production in the future, reports the Financial Times.

Saudi Arabia could remain the world's leading producer in 2020, admits Fatih Birol in a telephone interview.

Will shale oils play Big Oil the same trick as Alaskan oil? Launched between the two oil shocks of the 1970s, the production of Alaska was supposed to allow, according to its promoters at the time, to free the United States from the grip of OPEC. Ten years after its start-up, Alaskan crude began its decline:

Last remark (for now) on this new issue of the IEA's World Energy Outlook – whose previous opus had confirmed that the peak of conventional oil – 80% of world crude production – was crossed in 2006:

on the same graph where we see the future production of the United States hypothetically surpassing that of Saudi Arabia in 2017, we see that the IEA expects Russia, the current second largest producer, to begin a slow decline from 2015.

We will definitely have the opportunity to come back…

Note to readers: the conditions for hosting this blog on the Le Monde site have been modified (as I have already indicated in the comments to my previous post, as well as via Twitter).

The entire blog remains accessible under the same conditions.

However, it is now difficult for me to feed 'oil man' as I did until now, because I am no longer paid to do so.

I have therefore made the decision to quickly install a tool that will allow those who wish to do so to support me financially, so that I can ensure a more regular and, I hope, more frequent publication.

Thank you for your understanding, and take this opportunity to salute once again the quality and diversity of your comments.

Matthew Auzanneau.

Related Articles